First Impressions on SAP Notes for the Tax Reform

First Impressions on SAP Notes for the Tax Reform

The first three update notes regarding the Tax Reform in SAP were released on Friday, January 17, 2025. I took a look at the data, and here’s what I’ve gathered so far.

The notes on me.sap.com:

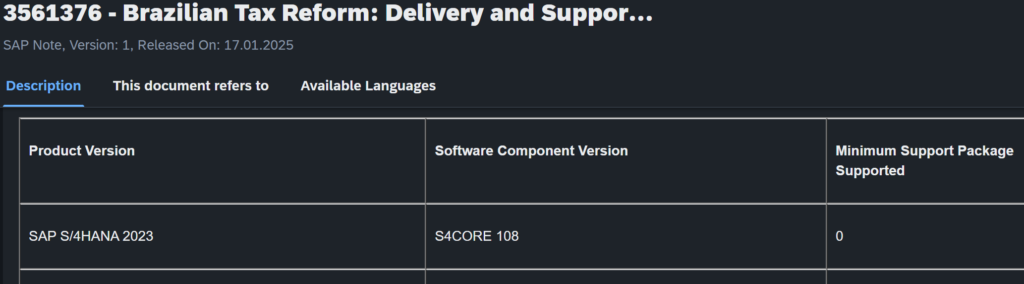

-3561376 – This note will be updated with future reform updates, so add it to your favorites.

-3552901 – Update for the J1B*N code to sum up taxes to nf total.

-3552903 – Technical prerequisites to update domains and data structures

The first note provides information and recommendations and confirms the required support package levels for each supported version, from S/4HANA to ECC. This is particularly useful for those using older ECC versions to determine whether an SP upgrade will be necessary.

At the end of the note, there is a list of other newly released notes, and according to SAP’s statement, this note will be updated with new releases in the future.

The notes in the S/4HANA system:

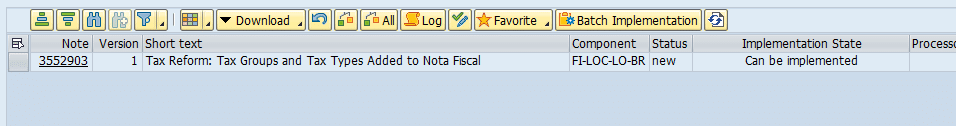

Moving on to the technical side, I downloaded the next two notes and started implementing them in SNOTE.

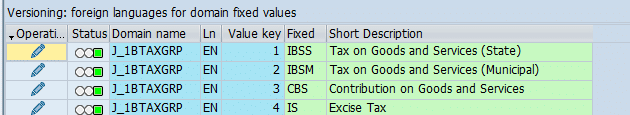

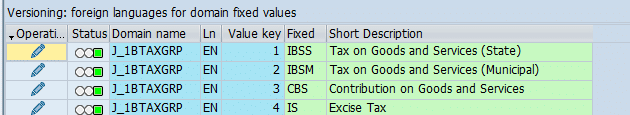

The prerequisite note introduced updates to the J_1BTAXGRP domain, adding more entries to accommodate IBS (state and municipal), CBS (federal), and the Selective Tax.

It took me just 5 minutes to implement the note in S/4HANA, and I moved on to the second note:

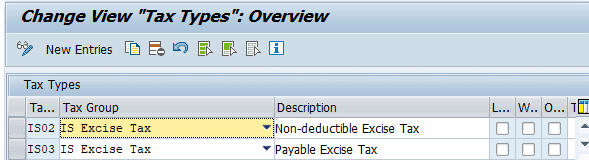

This was another quick update, with one manual step to upload a BC-Set with new configurations for the NF Tax Types.

Changes delivered by the notes

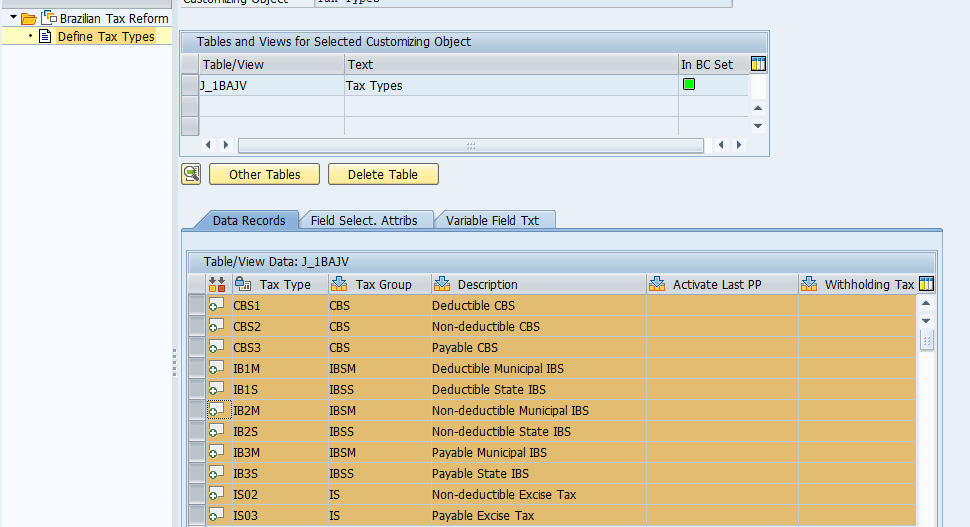

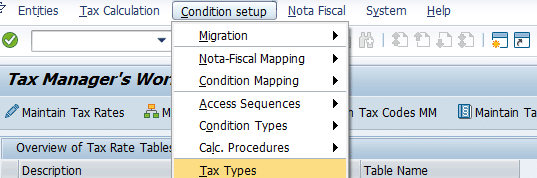

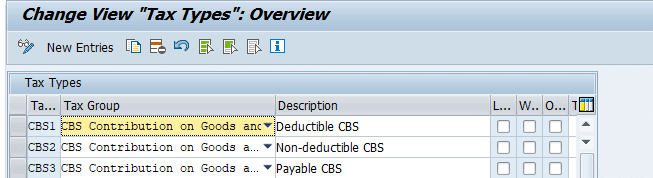

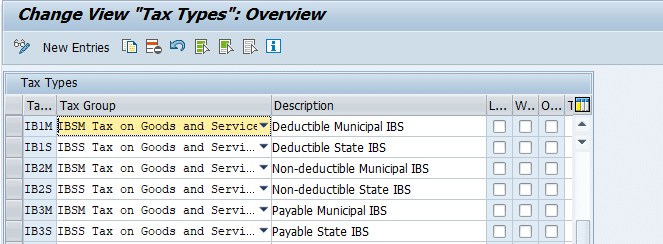

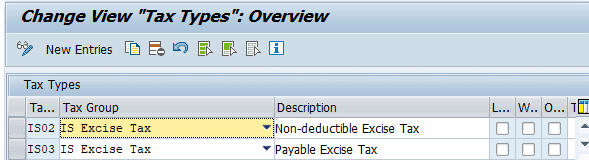

After implementing the notes, I checked J1BTAX and reviewed the Tax Types:

In addition to the three new tax groups (IBS, CBS, and IS), new entries were added to cover different tax cases (Deductible, Non-deductible, and Payable):

CBS – Contribution on goods and services

IBS – Tax on goods and services

IS – Selective Tax

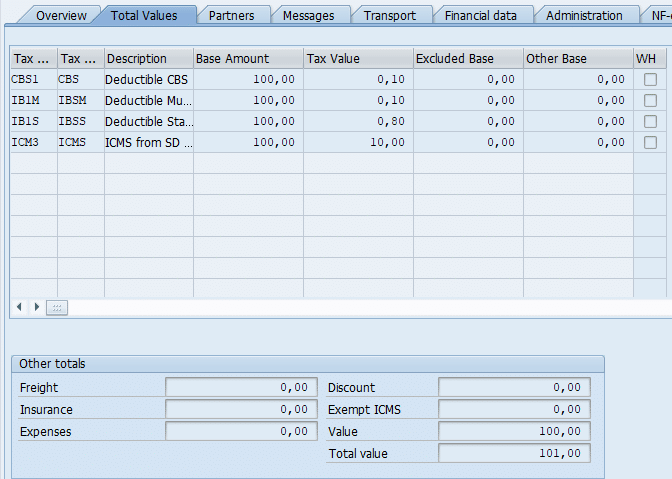

In the end, besides the new configurations, the SAP note introduced logic changes in the function codes (J_1BNFVALUEDETERMINATION) used in J1B*N to sum the group/tax type data in the total amount of the Nota Fiscal, as shown in the example below.

Currently, the update does not cover:

- Changes in MM and SD, DRC NFe, GRC NFe, Taas, and/or BAPI’s/BAdI’s

- Changes in J_1BNF* tables to include new fields

- Changes in SD and MM calculation schemas to calculate taxes

- Changes in SPEDs, CTR calculation views, or TDF/DRC shadow tables.

My impressions so far:

- With the information on support packages and the initial notes, it is possible to start analyzing the current system and defining the prerequisites that will need to be implemented.

- It is important to assess possible impacts on current developments/interfaces affected by these notes so far.

- For companies with Sandbox systems or a separate project track, it’s also possible to start implementing the notes to test their impacts.

Good Luck, folks!

Renan Correa

Quer ficar ligado nas novidades de localização? Entra no grupo da S4CN no Telegram e segue a gente no canal do Youtube

Mais infos sobre a localização Brasil no ERP, direto da sap, vocês podem conferir no SAP community na tag de S/4HANA logistics for Brazil

Outros posts sobre Localização você pode conferir filtrando pela categoria NFE/CTE ou Localização BR Geral.

Good job, keep’em coming.