SAP ERP Rollout to Brazil with SAP S/4HANA – Part 2

SAP ERP Rollout to Brazil with SAP S/4HANA – Part 2

Now we can go into details for each of the main Brazil country specific challenges listed above as well other important information:

Real-Time Integration of electronic Documents NF-e/NFS-e/CT-e (eInvoicing)

Probably the most known example of the brazilian legal complexity for business is the Electronic Invoice (NF-e) and the level of detail of it is what makes it special.

Unlike other eDocuments being currently implemented in Europe the Brazilian NF-e is way more detailed (more than 500 tags) and the rules to accept the documents are more strict (more than 400 different validation rules), that happens also because Brazil has more tax complexity than any other country. There is no VAT or Sales-Tax and instead there is a full dictionary of taxes such as ICMS, ICMS-ST, ISS, IPI, PIS, COFINS, CIDE, IRRF, INSS and II.

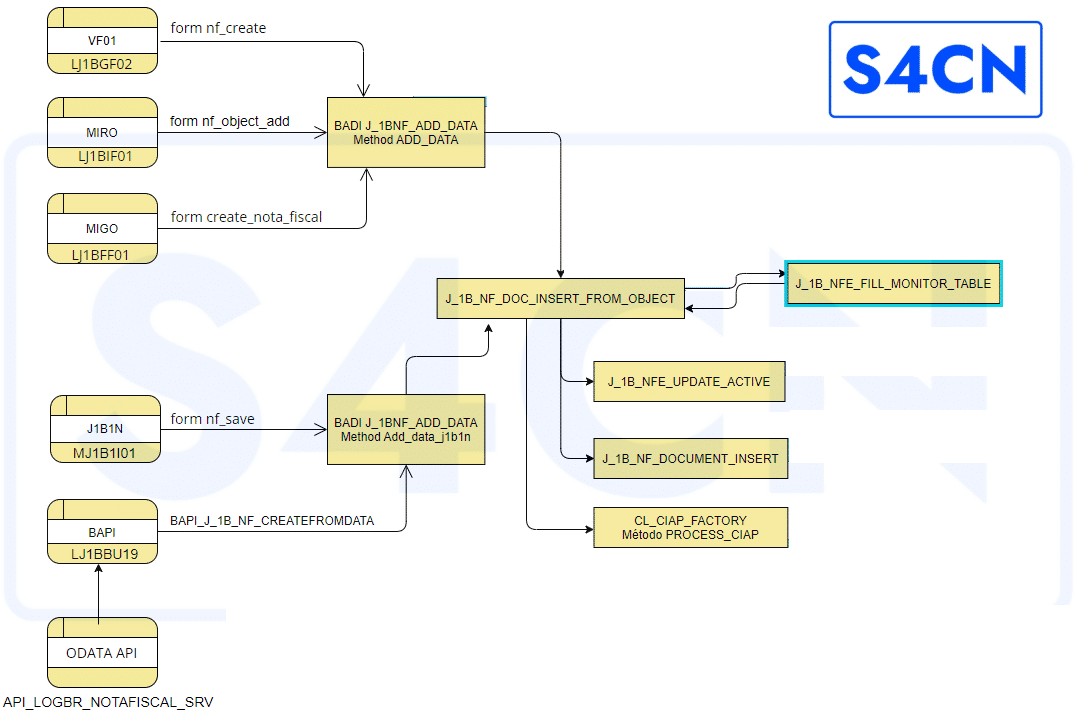

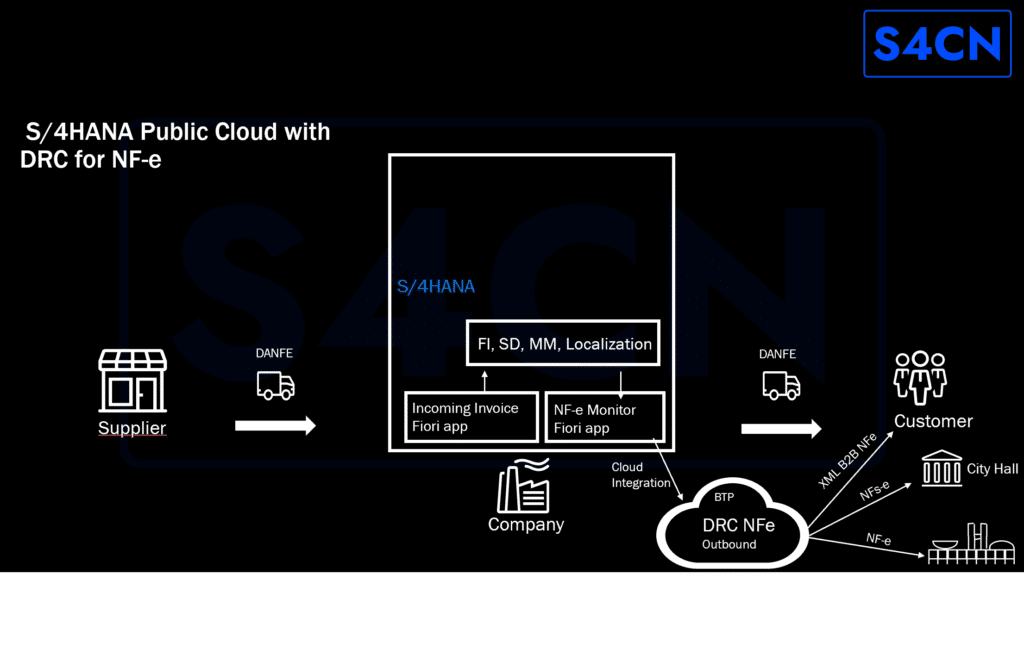

The NF-e can be generated from the billing document, from the MIRO invoice, from goods movements or as a standalone document, so it’s an additional document/object in the process flow and not merely an IDOC or Print-out based on core SAP documents in SD and MM. The diagram below shows technically how it happens in SAP:

There are two parts of the NF-e solution, the ERP data extraction/mapping and the messaging system that builds the XML and communicates with the authorities. The ERP part (the creation and filling of the nota fiscal) is a complex process, there are mani BAdI’s necessary to fulfill the legal requirement and depending on the industry extensive developments will be needed in the localization process (e.g. Pharmaceuticals, fuel and automotive companies have special industry specific tags without any standard mapping). On the inbound side developments are also necessary in BAdI’s and depending if you use EWM/TM then special integration for the incoming invoices has to be developed/designed, making the integration more difficult.

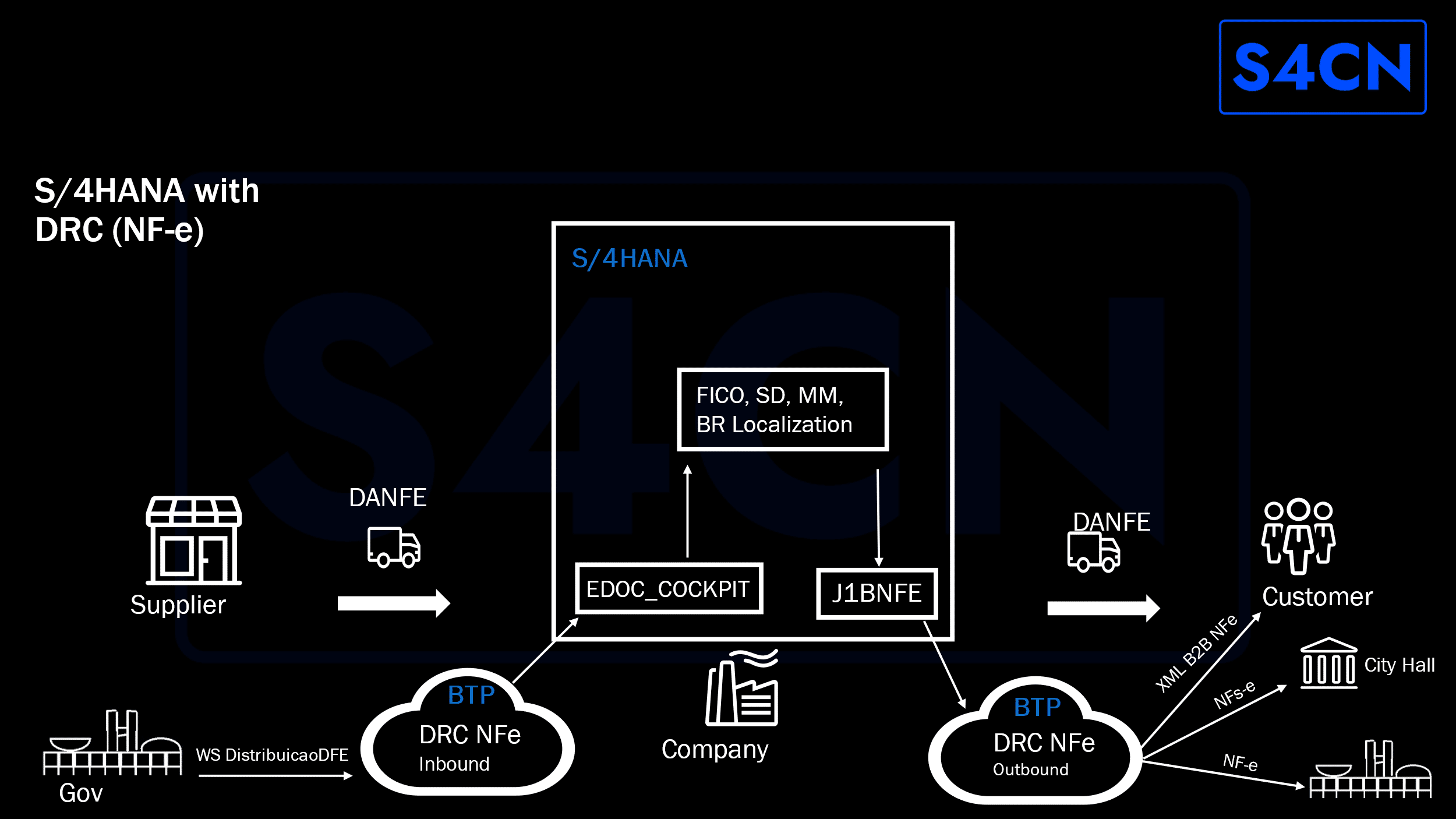

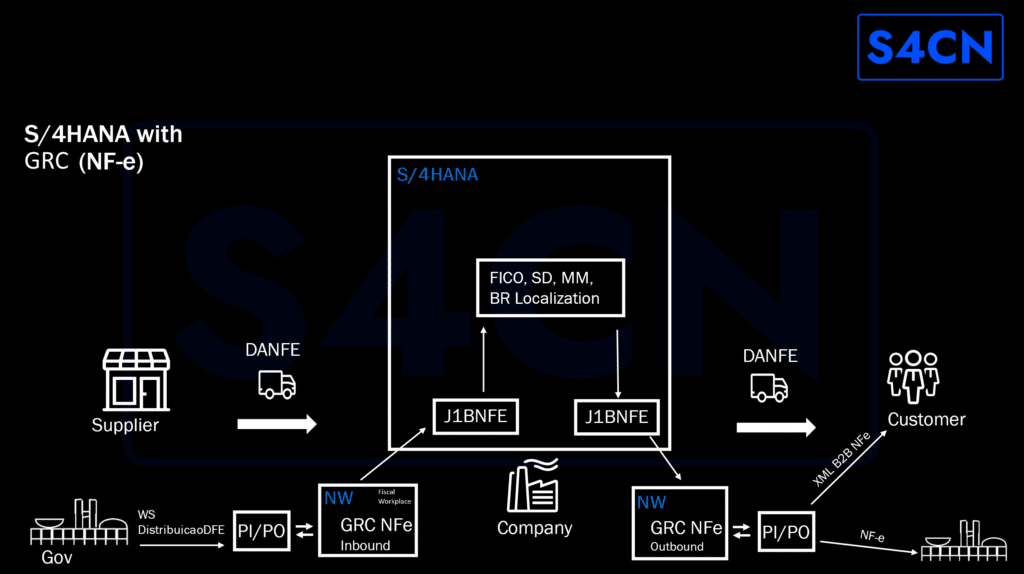

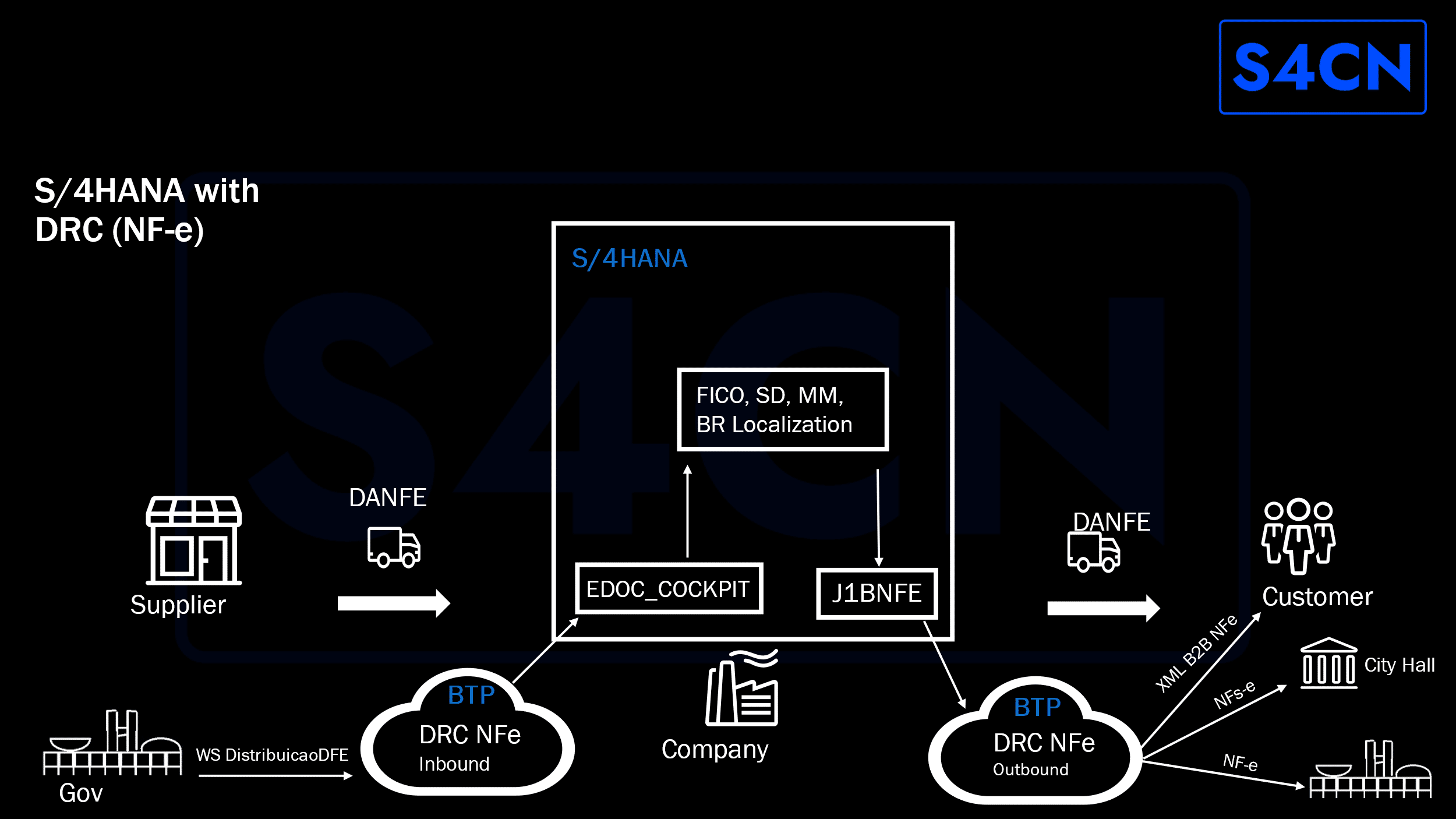

There are different solutions for the messaging system depending if you have a classic on-premise, a private cloud or a public cloud S/4HANA. It can be either GRC NF-e, DRC or a 3rd party solution.

Let’s check them in more details:

NF-e solutions for S/4HANA On-Premise / Private Cloud from SAP

The SAP solutions for NF-e currently available are SAP Electronic Invoicing 10.0 / SAP NFE 10.0 for S/4HANA (aka GRC NFE) and SAP DRC NF-e (Outbound/Inbound).

SAP GRC NF-e (Classic solution for on-prem)

The SAP classic on-Premise NF-e solution GRC NF-e has both inbound and outbound functionalities (separate licensing for each one) and it requires you to install it on an on-premise NetWeaver server and communicate with authorities through PI/PO interfaces, so that has a limited lifetime considering end of Maintenance for both GRC and NW 7.5.

Outbound

The outbound solution receives data from ERP via RFC and builds the XML of the electronic invoice, sign it and send to PI that communicates with government. The company is responsible to maintain certificates, update with OSS Notes and monitor technical interfaces. It supports NF-e/NFC-e and CT-e with larger scope and MDF-e with limited scope (only as messaging system).

Inbound

The inbound automation receives XML from government webservice (or from partners via PI / e-mail) and processes them to allow the posting of the goods receipt and the invoice receipt with RFC functions similar to BAPI’s. It’s integrated into ERP so the majority of the BAdI/Development implementations are done in S/4HANA side. It supports NF-e and CT-e.

Additional Info

It does not support NFS-e ( Service Electronic Invoices ) neither inbound nor outbound. Service Invoices are a special topic as service documents are linked to each city hall and there are several different file formats and integration methods such as WebServices, WebPortals and also still old paper invoices ( not all city halls work with electronic service invoice ).

GRC Maintenance is planned to end in 31.12.2025, so the recommended solution for new projects is the DRC NF-e. If you currently have GRC NF-e it’s strongly recommended that you start planning a migration of the solution.

SAP DRC NF-e (Current solution for all scenarios)

DRC is a global solution for eCompliance in SAP and it also has a localized version for Brazil. It’s different than other countries because the outbound scenarios use J1BNFE instead of edoc_cockpit and the data mapping should happen when posting the Nota Fiscal in ERP and not when sending the XML to authorities with BTP. The interfaces for DRC in BR are quite different from other countries and specialized consultants are necessary to understand and configure/develop the BR specific scenarios.

Outbound

In summary SAP already developed a replacement solution for the on-premise NF-e and has live customers using it. The product covers NF-e, CT-e and NFS-e ( for RJ and SP city hall ). This solution is not based on the eDocument Framework from SAP but uses SAP BTP for communication. SAP recently released a partner enablement solution where partners can integrate NFS-e with other city halls using CPI/Integration Suite iFlows.

The main limitation of DRC NF-e is that it cannot send DANFE as PDF via e-mail to business partner. This is a gap in all projects.

Inbound

The SAP Cloud solution for Incoming NF-e’s is based on the eDocument Framework and it has been released after the outgoing part. The scope of NF-e inbound is similar of GRC NFE, but SAP is developing additional functionalities for this solution. Right now it supports incoming NF-e/CT-e (no NFS-e, NFC-e or NF3-e) and it requires extensive developments to make the solution integrate with EWM/TM, to receive materials with batches/serials and to include validations of details of the XML. The solution does not offer any workflow functionality.

Additional Info on Edocuments

There is one lecture from SAP Inside Track Brazil where I explain more technical details about the eDocument Framework from SAP.

https://www.youtube.com/watch?v=oderSeiOwxA&feature=youtu.be

3rd party options for On-Prem/Private Cloud

It’s interesting to highlight that it’s possible to acquire from SAP partners other NF-e solutions as a service (installed, managed and monitored by partner ) which is also a viable cloud solution for E-Invoicing, as a good example of this kind of solution you can find cbs EWC eInvoice World Cloud among many others from SAP partners.

NF-e Solutions for S/4HANA Public Cloud

The S/4HANA Public cloud solution only offers more limited options as of now.

SAP DRC NF-e (only SAP solution for Public Cloud ERP)

The DRC NF-e BTP solution is a SaaS solution integrated to the public Cloud via a specific scope item and its respective communication scenario.

Outgoing

Only DRC NF-e is available for NF-e/CT-e and NFS-e. The extensibility of the solution is different as well as you can only the cloud BAdI’s for NF-e. The implementation of S/4HANA Public cloud in Brazil requires the activation of DRC scope items and needs to be thoroughly analyzed by experts to complement it and support the business scenarios.

Incoming

Incoming automation from DRC is not available as of 2024 and is not visible on SAP roadmaps yet.

3rd party options

In the case of public cloud 3rd party options are limited to solutions that triggers postings in S/4HANA based in API’s provided by SAP, it’s possible to look for some alternative solutions as extensions in BTP.

That’s all for now, Folks!

Stay tuned for the next chapters, part 3 will be related to taxation in BR and the planned tax reform…

Wanna learn more about Brazil, Latam and DRC in the SAP world? Subscribe to our Youtube channel!

You can also check our content by filtering TDF/ACR/DRC categories in our blog.

Would you like to have a consultation about a rollout to Brazil? Please send us an email with your enquiry and we’ll get back to you.